If you need to find the right coverage for your business, these 8 steps can help you compare business insurance quotes and make the right choice. This will ensure your business is protected in case something happens!

Small business insurance is important. You need to find the right one for your company. You also must think about other things, like how much you will pay in premiums each year.

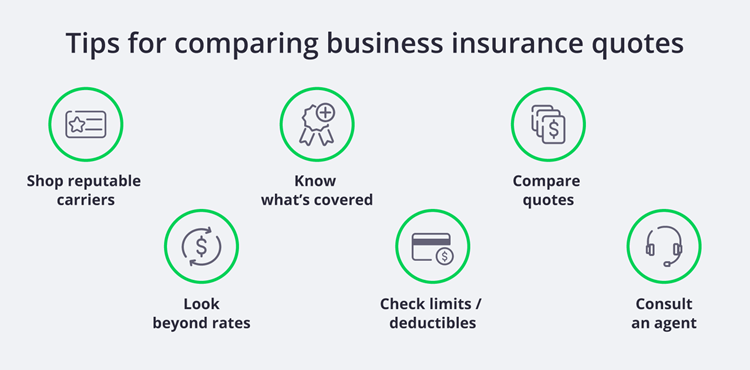

There are several elements to consider, such as your top business risks, policy exclusions, and coverage limits. These eight tips from the i.e. Insurance team will help you compare small business insurance quotes and find the right policy for your business.

1. Start with reputable insurance carriers

It’s a good idea to obtain quotations from reputable insurance companies. You don’t want to buy a bargain-basement insurance policy only to find out that your insurer can’t pay a claim. There are several rating agencies that evaluate insurance firms’ financial soundness. Avoid any firm that isn’t living up to the standards.

Insurance companies that work with us are all A-rated, so you can be sure that your insurer will be there when you need them. It’s important to have that peace of mind, especially when it comes to your business insurance.

2. Consider more than just insurance rates

When you’re comparing small business insurance quotes, don’t just focus on the price. Make sure you understand what each policy covers and excludes. The cheapest policy might not cover everything you need.

Also, be aware that some insurers will try to sell you add-ons that you don’t need. For example, many business owners don’t need identity theft insurance because they already have coverage through their credit card companies.

Keep in mind that you’re buying business insurance to decrease the chance of a financial loss when determining whether or not an offer is attractive. If an insurance company charges less than the competition, it is probably because the company’s policy has less coverage.

There are a number of methods to cut small business insurance premiums while still obtaining the protection you require. Consider alternatives like:

- Purchasing a business owner’s policy (BOP), which combines general liability insurance with commercial property insurance, usually at a discount.

- You can also save on your insurance costs by raising your deductibles and lowering your policy limits.

- Paying your yearly policy premiums instead of monthly.

If an insurance company offers a lower price than its competitors, there is probably a reason for it. The company may have less coverage, longer waiting periods for certain types of claims, or higher deductibles.

3. Make sure you know what’s covered.

The cost of a commercial insurance policy varies dramatically from policy to policy and insurer to insurer. Carefully review each policy and coverage choice so you know exactly what you’re receiving.

All insurance policies will list their inclusions and exclusions, or the occurrences that are and are not covered. Pay attention to these things since they influence your coverage’s terms.

When comparing commercial vehicle insurance rates, you’ll want to know the amount of coverage each policy provides for bodily injuries, property damage liability, collision coverage, uninsured motorist coverage, and personal injury protection.

You may discover specifics about what’s covered by the most popular small business insurance policies:

- BOP insurance: This type of policy includes general liability insurance, commercial property insurance, and sometimes other types of coverage, like business interruption insurance.

- Product liability insurance: This type of policy covers your business if it’s sued because one of your products injured someone or damaged their property.

- Professional liability insurance: Also called errors and omissions insurance, this type of policy covers your business if you’re sued because you made a mistake in your work or gave someone bad advice.

- Commercial property insurance: This type of policy covers damage to the physical property your business owns, like your office space or inventory.

- Commercial vehicle insurance: If you use vehicles for business purposes, this type of policy covers damage to them and injuries that occur if one of your employees has an accident while driving for work.

- Workers’ compensation insurance: This type of policy is required in most states if you have employees. It covers medical expenses and a portion of lost wages if an employee is injured on the job.

Never assume that the coverage offered in each quotation is the same, regardless of what kind of policy you’re looking at. You don’t want to buy a policy only to discover that it doesn’t include the coverage you require when it’s time to submit a claim.

4. Check policy limits and deductibles

The maximum amounts that your insurer will pay for a certain event, instance, or claim under a policy are known as policy limits. You’ll want to pick the limits that will defend you adequately against claims involving liability, as well as other financial setbacks.

There are two sorts of restrictions: per-occurrence and aggregate.

- Per-occurrence limit: The maximum amount your policy will pay out for any single claim.

- Aggregate limit: The maximum your insurance will pay for all claims in a single policy year (usually one year).

Frequently, your client contracts, property lease, or mortgage agreement will need you to obtain liability coverage such as a general liability insurance policy or a professional liability insurance policy. If they offer minimum levels of coverage, you’ll almost certainly be required to maintain them. Check that the policies you’re purchasing satisfy any obligations you may have.

Your deductible is the amount you have to pay out of pocket before your insurance policy will start paying. A lower deductible means a higher premium and vice versa. The right deductible for you depends on the amount of financial risk you’re comfortable taking on, as well as other factors specific to your business.

However, keep in mind that a higher deductible also means more out-of-pocket costs if you do have to make a claim. If you don’t think you could afford to cover a high deductible, it might not be the best option for you.

For example, say you have a $1,000 deductible on your commercial property insurance policy. If your office is burglarized and you have to pay a $1,500 deductible, you’ll be out of pocket $500.

5. Pick a policy that can grow with your business

Consider how quickly your company could develop in one year if you’re comparing small business insurance rates. When examining limits, inclusions, and exclusions, you’ll want to leave a little room so that your insurance continues to meet your demands – even if business picks up..

6. Compare quotes with your current insurance coverage

Take a look at your existing policy (if you have one) before comparing quotes for different sorts of insurance. Consider your present policy and what you like and dislike about it. What is it lacking? Are these new policies more comprehensive than those you already have? Your present insurance policy might be a good indicator of whether you’re getting adequate coverage for a fair price.

7. Consider how soon you’ll need coverage

Where you purchase your insurance can impact how quickly you will get coverage. If you need to sign a lease or land a big client contract, you might need to secure coverage as soon as possible. If you need insurance right away, make sure that there will be no delay in getting the insurance that you need. Talk to your agent or your carrier to make sure everything goes smoothly.

Get a head start. When you begin a quotation, you may quickly compare rates from top carriers and receive a certificate of insurance the same day.

8. Ask your agent for guidance

One of the most significant advantages of working with an insurance agent is that they can assist you in determining your greatest insurance requirements, making good judgments, and guiding you through the comparison process.

Because quotations you receive on the internet are based on the information you provide in your application, they aren’t definitive. If you enter information incorrectly or if you don’t understand a question, your quote may change as the agent helps you to clarify the answers.

Bottom Line

When you’re buying small business insurance for the first time, it’s essential to understand what coverages are available and how they might fit into your business. These tips will help you get the most out of your quote comparisons, so you can choose the best policy for your company.

If you have any questions, please feel free to contact us at i.e. Insurance LLC. We’re always happy to help business owners find the right insurance for their companies. Talk to us today at 724-719-2093 or contact us online.